what is 1601c|BIR Form No. 1601C : Tagatay What is BIR Form 1601C, or the Monthly Remittance Return of Income Taxes Withheld on Compensation? All business entities in the Philippines are required by law . 1,262 pinay bisaya FREE videos found on XVIDEOS for this search. Language: Your location: USA Straight. Login Join for FREE Premium. Best Videos; Categories. Porn in your language; 3d; AI; Amateur; . Pinay ex-gf pumayag magpa-iyot sa pwet 11 min. 11 min Tsupahera - 998.7k Views - 360p. PINAY NAIHI SA TALONG 70 sec. 70 sec .

PH0 · Use BIR Form 1601

PH1 · Simplifying Taxation for MSMEs: File your BIR Form 1601C even

PH2 · Generating BIR Form 1601

PH3 · Form 1601

PH4 · Did You Know You Can File BIR Form 1601C via Taxumo?

PH5 · Did You Know You Can File BIR Form 1601C via

PH6 · BIR Form No. 1601C

PH7 · BIR Form No. 1601

PH8 · BIR Form 1601C: Purpose and Guidelines in the Philippines

PH9 · BIR Form 1601C

PH10 · Availability of BIR Form 1601

Vision One Eyecare in Carrum Downs is now called Carrum Downs Eyecare. Your trusted friendly team and faces are still there to assist you with all your eye care needs. Carrum Downs. Carrum Downs Shopping Centre Shop 18, 100 Hall Road, Carrum Downs VIC 3201. 03 9782 9411. [email protected].

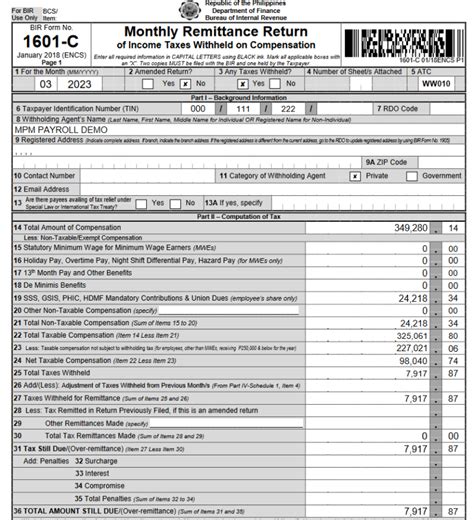

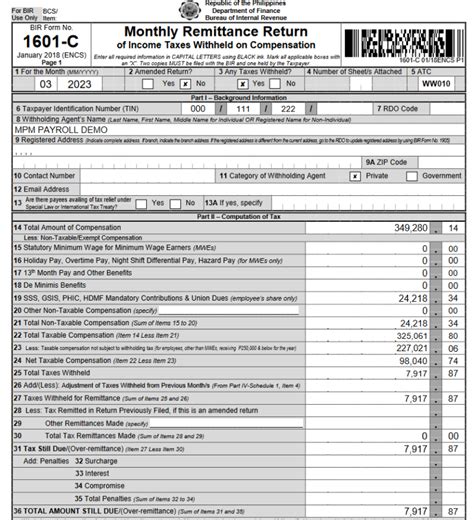

what is 1601c*******BIR Form No. 1601-C Monthly Remittance Return of Income Taxes Withheld on Compensation. Guidelines and Instructions. Who Shall File. This return shall be filed in triplicate by every withholding agent (WA)/payor who is either an individual or non .Monthly Remittance Returnof Income Taxes Withheldon Compensation. 1. For the .

Monthly Remittance Returnof Income Taxes Withheldon Compensation. 1. For the Month (MM/YYYY) 01 - January 02 - February 03 - March 04 - April 05 - May 06 - June 07 - .

BIR Form 1601C is the monthly tax return for employers who withhold tax on compensation of their employees. Learn what is compensation, how to comput.

What is BIR Form 1601C, or the Monthly Remittance Return of Income Taxes Withheld on Compensation? All business entities in the Philippines are required by law .what is 1601c BIR Form No. 1601C BIR Form 1601-C is a report that businesses file every month to show how much taxes they have withheld from their employees' pay. Learn how to use this form as . BIR Form 1601C is a monthly tax return for employers who withhold income tax from their employees' salaries. Taxumo helps you enter, compute, and file your 1601C forms online with less hassle and .Form 1601-C or Monthly Remittance Return of Income Taxes Withheld on Compensation is filed by a Withholding Agent who deducts and withhold taxes on compensation paid to employees. Related Articles: Adding .

What is it? Form 1601-C, or Monthly Remittance Return of Income Taxes Withheld on Compensation, is filed by employers when they withhold or remove the applicable . BIR Form 1601-C is a monthly report of taxes withheld on compensation by withholding agents /payors. It is available in eFPS and must be used according to the . BIR Form 1601C is the tax form for withholding tax on compensation (WTC), which is the monthly deduction from employees' salaries. Learn how to file, compute and .

The BIR has released its new form on the remittance of monthly withholding taxes on compensation last November 2020 - the new BIR Form 1601-C (with a dash). .

To file a BIR Form 1601-C in Fast File, follow the steps below: STEP 1: From your portal, click on the Start Return button. STEP 2: Select Income Taxes Withheld on Compensation and hit Next. STEP 3: Since 1601C is automatically selected, just click the Next button to proceed to the next step. STEP 4: Select the date of the transaction covered .

1 Every time a tax payment or penalty is due or an advance payment is made; 2. Upon receipt of a demand letter / assessment notice and/or collection letter from the BIR; and. 3. Upon payment of annual registration fee for a new business and for renewals on or before January 31 of every year. BIR Form No. 0611-A.Take note that each time a salary is given, you should input it as a salary expense under the Compensation tab. So it follows that if you release salaries semi-monthly, then that's two salary expenses in the Compensation tab per employee. Additionally, you should categorize each salary expense as semi-monthly! ON NOVEMBER 27, 2020, the Bureau of Internal Revenue (BIR) issued Revenue Memorandum Circular (RMC) 125-2020 to inform the public on the availability of the new BIR Form 1601-C (Monthly Return of Income Taxes Withheld on Compensation) January 2018 (ENCS) in the Electronic and Payment System (eFPS).

The BIR 1601-C is called the "Monthly Remittance Return of Income Taxes Withheld on Compensation.”. You summarise your company's payroll and accounting software computation. The best part is no names or individual pay data are displayed. Philippine law mentions that you can break the components into taxable and non-taxable .Add Compensation (s) Manually. STEP 1: On the Reports page, select the Sources tab, then click on the (+) add/plus icon to add compensation. STEP 2: Enter information such as Basic Pay, Non-Taxable Compensation, Other than Non-Taxable Compensation as well as Gross Income and Tax Amount. After that, click the Save Changes button to update your .

BIR Form 2307 is also called the Certificate of Creditable Tax Withheld At Source. This certificate shows the income subjected to expanded withholding tax paid by the withholding agent. First, download a copy of the form from the BIR website. Filling one out is pretty straightforward but you do need to have the taxpayer details of the payee .BIR Form No. 1601C The BIR Form 1601C also called Monthly Remittance Return of Income Taxes Withheld on Compensation is the tax form used to file for Withholding Tax on Compensation (WTC). WTC is the monthly tax deductions made by employers on the salaries and wages before paying their employees. This withholding process is implemented to streamline .

Running a business does not only equate in earning profits and giving satisfaction to the market. Instead, there is also an inherent obligation to their employees and to the government. That is why Bureau of Internal Revenue (BIR) designed BIR Form 1601-c or Monthly Remittance Return of Income Taxes Withheld on Compensation wherein it .The end of the calendar year is near and during the year-end, companies with employees will perform tax annualization to determine the final income tax due to be reported to the BIR. It is also the time where companies determine if there is a tax refund applicable to certain employees. There are too many rules to remember in computing payroll .

This form must be filed on or before 31 January of the year following the calendar year in which the compensation payment or any other income payments were accrued or paid. For example: BIR Form 1604-C relating to the year 2020, must be filed by 31 January, 2021. Along with the form you’ll need to attach some documentation.

For members of the Philippine Bar (individual practitioners, members of GPPs): b.1 Taxpayer Identification Number (TIN); and. b.2 Attorney’s Roll Number or Accreditation Number, if any. Box No. 1 refers to transaction period and not the date of filing this return. The last 3 digits of the 12-digit TIN refers to the branch code.CLASSIFICATION OF WITHHOLDING TAXES. Creditable withholding tax ; Compensation - is the tax withheld from income payments to individuals arising from an employer-employee relationship.; Expanded - is a kind of withholding tax which is prescribed on certain income payments and is creditable against the income tax due of .Company. Unit 408 Lumiere Suites Capinpin Street, Brgy. San Antonio Pasig City, Metro Manila Philippines 1605 Email: [email protected] Phone: +63917.155.6537 a. Annually – use the annualized computation (see no. 3 below). b. Quarterly and semi-annually – divide the compensation by three (3) or six (6) respectively, to determine the average monthly compensation. Use the monthly withholding tax table to compute the tax, and the tax so computed shall be multiplied by three (3) or six (6) .

1601C (Monthly Remittance Return of Income Taxes Withheld on Compensation) - Deadlines: For manual filer: For the months of January to November - on or before the tenth (10th) day of the following month in which withholding was made; For the month of December - on or before January 15 of the following year; For eFPS filers: refer to RR .

In this video, I will show you how to prepare and file 1601C using the EBIR Forms and EFPS. I really suggest that you have already prepared a working paper w.

Want to bet on Floorball but don’t know where to start? Read BetZillion’s guide to the best Floorball betting sites in 2024 and get the latest odds and betting lines.

what is 1601c|BIR Form No. 1601C